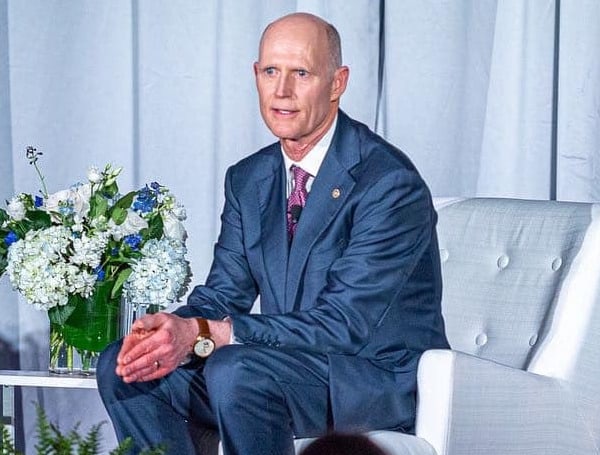

U.S. Sen. Rick Scott has been hammered in recent weeks saying that every American should pay something in taxes so we all have “skin in the game.”

It was a reference to the fact that 47 percent of Americans pay no income taxes.

Democrats have tried to claim Scott was attacking everyday Americans and would raise their taxes.

But Scott on Tuesday showed that Democrats – as they normally seek to do – plan on raising taxes on all income groups, if they can ram through President Joe Biden’s “Build Back Better” boondoggle.

The Florida Republican released a report by the congressional Joint Committee on Taxation that shows the effects of the proposal over the next decade.

Democrats seek to bring back the BBB plan piecemeal, starting with initiatives that focus on energy and healthcare. Yahoo News estimates the revamped packs could fuel $1 trillion in new spending – about half the original bill – even as inflation and the national debt continues to head upward.

In the news: REPORT: ICE To Transport Migrant Women Across State Lines So They Can Get Abortions

In a press release, Scott noted, “This reckless tax-and-spend proposal again breaks Biden’s promise not raise taxes on Americans making less than $400,000 per year.”

The JCT report, based on a version of the bill that already passed the House, shows that higher taxes would hit almost all income groups beginning next year.

For example, those who make between $20,000 and $30,000 a year would collectively pay $370 million more in taxes than they do under current law.

For those who earn between $50,000 and $75,000, that increase jumps to $2.3 billion. Among those between $100,000 and $200,000, it rises to $12.1 billion.

Ironically, the one group it would spare – millionaires. The uber-wealthy would actually pay $13.3 billion less in aggregate taxes next year.

But, by 2025, taxes would get boosted for all.

The JCT estimates that under BBB, for instance, those in the $50,000 to $75,000 range would still pay $2 billion more than they do now. By 2027, that group would fork over $3.6 billion more than they do now, and $3.8 billion extra in 2029.

Even the poorest Americans are not spared.

The JCT indicated that if BBB were enacted now, those making less than $10,000 a year would pay $30 million less than they do under current law.

Yet their share jumps by $182 million by 2025 – a shift of $212 million.

“It’s never been a secret that Democrats want to raise taxes on hardworking American families, and now the non-partisan JCT has made clear just how disastrous their plans truly are,” Scott said in a statement.

“Families in Florida and across the country are already paying Biden’s raging incompetence tax as prices at the grocery store and the pump keep climbing, but that’s not enough for the radical Left—they want the Feds to get more of your money too.”

In the news: Tampa Man Pleads Guilty To Child “Sex Tourism” In Colombia, Child Sexual Abuse Charges

“This isn’t just a tax hike on giant corporations or the wealthiest Americans—the Democrats are raising taxes on EVERY SINGLE INCOME BRACKET,” Scott added.

“It shows once again that in Washington, there are those of us that make plans and fight every day to cut taxes, and then there are the Democrats who put raising taxes as priority #1,” he continued. “Tax increases are never the answer, but pushing higher taxes during a record-breaking inflation crisis is shameful and disgusting. I will NEVER support raising taxes and will fight this reckless tax-and-spend agenda with every tool at my disposal.”

Visit Tampafp.com for Politics, Tampa Area Local News, Sports, and National Headlines. Support journalism by clicking here to our GiveSendGo or sign up for our free newsletter by clicking here.

Android Users, Click Here To Download The Free Press App And Never Miss A Story. Follow Us On Facebook Here Or Twitter Here.

Copyright 2022 The Free Press, LLC, tampafp.com. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Comments are closed.