|

Dear Friend –

Should tax-evading IRS agents be fired?

Let me know what you think:

The IRS Guilty of Tax Evasion!

My audit of the auditors finds thousands of IRS employees

owe millions of dollars in back taxes.

Joe Biden must have failed American history.

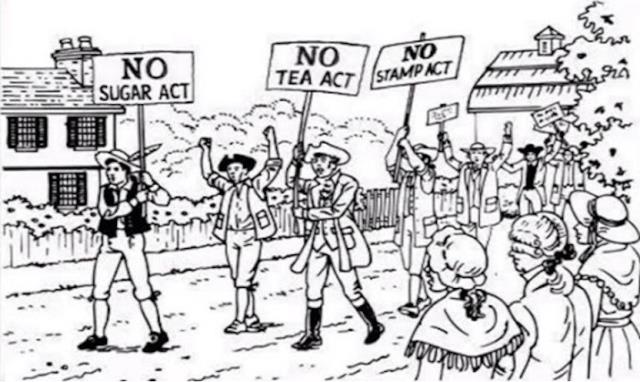

Biden says paying higher taxes is “patriotic” even though the American Revolution was sparked as a protest against taxation.

While Biden may have forgotten, the nation’s tax collectors apparently have not. The spirit of ‘76 is still alive and well with a tax revolt happening right now at the most unlikely of places in Washington, the IRS.

I audited the auditors and discovered thousands of IRS employees—whose salaries are funded by the taxes you pay—owe tens of millions of dollars in back taxes.

Like the real American patriot Paul Revere who alerted the colonists that “the British are coming” on his famous midnight horseback ride, I am issuing my own warning to these tax cheats at the IRS to pony up or I’ll be coming for your jobs.

The tax revolt that ignited the American Revolution is alive and well at the most unlikely place in Washington … the IRS, with thousands of the tax collection agency’s employees refusing to pay taxes.

My audit of the IRS reveals:

- More than 5,800 IRS and contractor employees owe nearly $50 million in overdue taxes.

- Of the 3,323 IRS employees with unpaid taxes, 2,044 owing more than $12 million were not on a payment plan.

- Of the 2,484 IRS contractor employees with unpaid taxes, 1,729 owing more than $17 million were not on a payment plan.

- Despite the IRS having the authority to fire employees who willfully fail to pay taxes, just 20 of the agency’s tax cheats were terminated.

- Over 500 former IRS employees with tax compliance issues or conduct and performance problems, including criminal misconduct, sexual misconduct, inability to perform duties, fighting and assault, and unauthorized access to tax return information, have been rehired by the agency and its contractors.

Government-wide, 149,000 federal employees owe $1.5 billion in unpaid taxes. Tens of thousands are repeat cheats, failing to file tax returns year after year and that number is steadily increasing.

My audit of the IRS found thousands of tax evaders owing nearly $50 million on the tax collection agency’s own payroll.

Yet, “the time the IRS dedicates to federal employee non-filers is minimal.” Instead of collecting the billions of dollars owed by bureaucrats, the president and the IRS are targeting lower-income and middle-class Americans with nearly two-thirds of the new audits.

While the IRS warns, “tax evasion is a serious crime punishable by imprisonment, fines, and the imposition of civil penalties,” the agency is rewarding its own tax dodgers with paychecks and lavish benefits made possible, ironically, with the taxes paid by you, me, and other hardworking Americans.

Democrats handed the agency an additional $80 billion to hire an army of IRS agents to audit the rest of America. The Biden-Harris White House says, “empowering the IRS” is all about fairness: “One of the most important ways that President Biden has added real fairness to the tax code is by providing the Internal Revenue Service (IRS) with the resources they need” for “enforcing tax compliance.” Folks, there is absolutely nothing fair about forcing the rest of us to pay the salaries of tax-evading tax collectors.

IRS auditors unmasking the real tax evaders.

That is why I’m giving my July 2024 Squeal Award to the IRS for auditing honest hardworking Americans while ignoring the overdue and unpaid tax bills of its own tax collectors.

Even the son of the President of the United States hasn’t been able to get away with tax evasion, and neither should those administering the tax law. That is why I’m calling on the IRS commissioner to verify that every current and prospective IRS employee is paying their taxes and to fire those who don’t. To make sure that happens, I'm also introducing the Audit the IRS Act, requiring regular audits of agency employees and the termination of every IRS agent who isn’t paying their taxes.

Squeal Award: Internal Revenue Service

For more updates on what's happening in Washington, D.C. and Iowa, be sure to 'Like' my Facebook page, follow me on Twitter and Instagram @SenJoniErnst, and subscribe to my YouTube channel.

Thank you!

|