|

Daily Coronavirus Update - April 20, 2020

" We can't underestimate the power of working together during this difficult time. My office and I will continue to keep you informed on my website and through the daily newsletter as best we can. As always, if you have tried to obtain assistance and still need help, please reach out to me through email at common_sense@manchin.senate.gov or leave a message at 304-342-5855. Stay West Virginia Strong."

- Joe

|

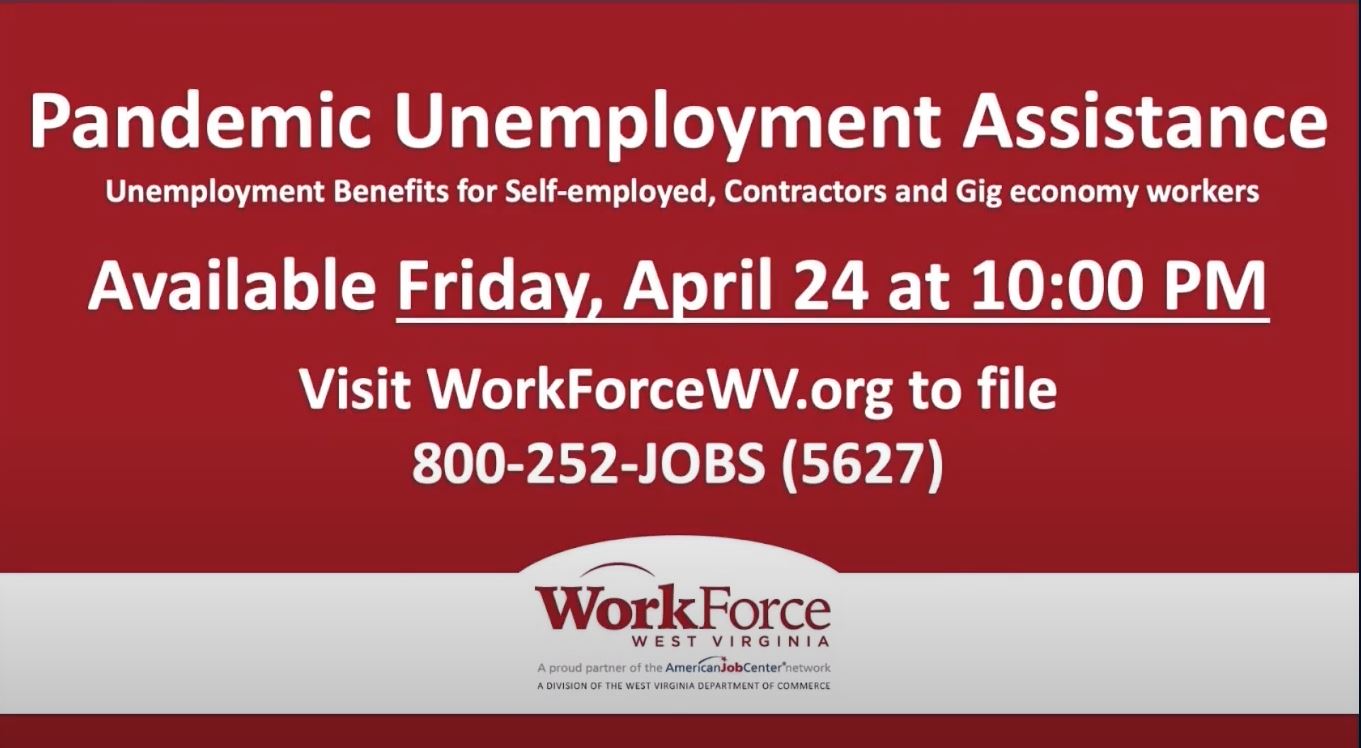

Unemployment Assistance Available Friday |

|

|

Action Needed by April 22 for Social Security Recipients with Dependents Who Do Not File Tax Returns to Receive $500 Per Child Payment |

|

SSA, RRB recipients with eligible children need to act by Wednesday to quickly add money to their automatic Economic Impact Payment

The U.S. Department of the Treasury and Internal Revenue Service urge social security, railroad retirement and Veterans benefit recipients who have qualifying children and did not file a 2018 or 2019 tax return to go to the IRS Non-Filer tool by Wednesday, April 22, and enter basic information to receive the $500 per eligible child added to their automatic $1,200 Economic Impact Payment.

Those receiving federal benefits – including Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, or Veterans Administration benefits – who have qualifying children and who were not required file a tax return in 2018 or 2019 should go to IRS.gov and click on the “Non-Filers: Enter Payment Info Here” button. The tool will request basic information to confirm eligibility, calculate and send the Economic Impact Payments:

· Full names and Social Security numbers, including for spouse and dependents

· Mailing address

· Bank account type, account and routing numbers (leave blank if you receive your benefits through Direct Express)

By entering this information, they can receive the $500 per dependent child payment automatically in addition to their $1,200 individual payment. Otherwise, their payment at this time will be $1,200. By law, the additional $500 per eligible child amount would be paid in association with a return filing for tax year 2020.

Supplemental Security Income (SSI) recipients will have until a later date to provide their information in the IRS Non-Filers tool. |

WORKING FOR YOU |

|

MANCHIN URGES CONGRESSIONAL LEADERS TO EXPAND HEALTHCARE COVERAGE IN FUTURE CORONAVIRUS EMERGENCY FUNDING

Charleston, WV – Today, U.S. Senator Joe Manchin (D-WV) led 38 Senators in pressing congressional leaders to ensure that any future coronavirus relief legislation includes strong measures to secure healthcare coverage for Americans in the wake of the COVID-19 pandemic. In a letter, the Senators urged Senate and House leaders to take steps to ensure that those who have lost their employer-based benefits, and those who are uninsured or underinsured, do not have to face this major public health crisis without access to health insurance.

“As you know, the COVID-19 pandemic has significantly impacted the employment security, financial stability, and health care coverage of millions of American families,” wrote the Senators. “Congress has taken unprecedented steps to provide immediate relief to many of these families, but unfortunately – to date – Congress has not included significant coverage provisions in its legislative efforts to address COVID-19.”

Read the letter here.

MANCHIN, CAPITO ANNOUNCE $3 MILLION FOR AFFORDABLE HOUSING IN WEST VIRGINIA

Charleston, WV – U.S. Senators Joe Manchin (D-WV) and Shelley Moore Capito (R-WV), members of the Senate Appropriations Committee, today announced $3,000,000 from the Department of Housing and Urban Development (HUD) Housing Trust Fund (HTF) through the CARES Act, which was signed into law by President Trump on March 27th, to preserve and expand affordable housing options and provide assistance for low-income families in West Virginia.

“Investment in public housing is critical to the health of our communities, especially during these difficult times with economic uncertainty and record unemployment caused by the COVID-19 pandemic. Everyone deserves a roof over their heads, no matter their circumstances. When people lose jobs through no fault of their own, having access to affordable housing can help them get back on their feet. When we get through this terrible pandemic, we will show everyone that nobody works harder than West Virginians, and I will continue to fight to ensure that everyone will have the opportunity to get back on their feet and have a roof over their head,” said Senator Manchin.

|

WV STRONG |

|

I was always taught that if you can count your blessings, you can share your blessings. It's my privilege to share some inspirational stories from those on the ground who are donating their time and energy to helping their fellow West Virginians. These are just a few of the countless acts of kindness happening in our state every single day. Share your stories or recommend someone to be recognized for being WV Strong by emailing WVSTRONG@manchin.senate.gov.

This story of a Better Angel comes from Morgantown, WV. After learning from his father that many truck drivers are struggling to find a place to stop and eat on the road due to restaurants closing, Logan Miller decided to do something about it.

He gathered his allowance with his parents’ blessing and went to the grocery store to stock up on snacks and bottled water so he could assemble care packages to hand out to truckers.

I truly appreciate Logan for his selfless, outstanding efforts and for bringing attention to those who are on the road driving hundreds of miles, day and night, and how this is impacting them. You truly are WV Strong.

Logan’s father, Jason, owns a freight truck business and his mother, Melissa, works at a local hospital in Morgantown. They’re among the many who are feeling the effects of this pandemic right now and I applaud them what they do and for supporting Logan’s determination to help others.

|

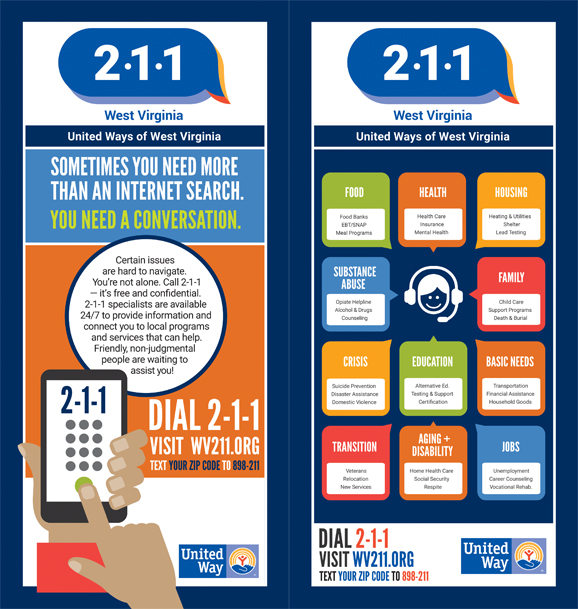

WV 211 |

|

U.S. Senator Joe Manchin (D-WV) is encouraging West Virginians to utilize the 2-1-1 program operated by United Way of West Virginia. 2-1-1 connects callers with health and human services resources through trained certified specialists. Anyone can call 2-1-1 to learn about specific programs, intake requirements, eligibility, operation hours and more.

“United Way of West Virginia provides an important service to West Virginians by helping users navigate the vast number of resources available to aid with healthcare issues, food shortages, mental health questions and more. This program is more important now than ever as we battle the COVID-19 pandemic and I commend United Way for continuing to serve their fellow West Virginians through this time,” Senator Manchin said.

“United Way’s new 2-1-1 will make information on a wide variety of local support services more accessible across our entire state,” said United Way of Central WV President, Margaret O’Neal. “Whether it’s information for locating a health clinic, finding child care programs, or getting housing assistance, 2-1-1 is an easy-to-remember, go-to resource for individuals and families.”

To utilize these resources West Virginians can:

Call 2-1-1

Text your zip code to 898-211

Visit http://www.wv211.org/contact

Call toll-free 1-833-848-9905

|

RESOURCES |

|

Our office is working diligently to bring you the most up-to-date information as it becomes available. Click the links below for more information. All information regarding resources and more can be found on Senator Manchin's website.

Unemployment & Direct Payments

Veterans Assistance

Basic Needs

Business Assistance

Volunteer

Feeling Ill?

Any new or updated information will be posted below. All information is updated daily on manchin.senate.gov/coronavirus.

Unemployment & Direct Payments:

Eligibility

Eligible self-employed, independent contractors and gig economy workers will be able to apply for unemployment benefits beginning Friday, April 24, at 10 p.m.

Direct Payments To West Virginians

To address unforeseen financial challenges not covered by expanded Unemployment Insurance benefits or modified Small Business Administration (SBA) loans, the bill authorizes direct payments of $1,200 for individuals and $2,400 for couples. Families are also eligible for an additional $500 per child. Working class Americans that file their taxes will receive a direct payment. Those who are on Social Security or otherwise do not file income taxes will receive their payment in the form of check.

An individual is eligible for the full benefit if they make less than $75,000 per year. Couples and other joint filers are eligible if their combined annual income is less than $150,000. Above that threshold, benefits will be reduced by $5 for every $100 of income and phased out entirely for those making $99,000 or more ($198,000 for couples).

Any individual making $99,000 or more per year will not receive any direct payment. Any couple or other joint filers making $198,000 or more per year will not receive any direct payment.

Veterans and their beneficiaries who receive Compensation and Pension (C&P) benefit payments from VA, and individuals that receive form SSA-1099, which includes those that are receiving Old-Age, Survivor, and Disability (OASDI) benefits through Social Security, and individuals that receive form RRB-1099, which includes those that have worked in jobs covered by the Railroad Retirement Act, will be eligible for the stimulus check and will not be required to fill out any additional tax documents. Veterans, Social Security recipients and railroad retirees who have dependents under the age of 17 can use a new IRS tool online to register to claim the additional $500 per dependent they are eligible to receive.

For all others who do not normally file their taxes, including seniors, they are also eligible to receive a check; however, in order to receive the stimulus payment, an individual that falls into one of these categories will need to file a simple tax return for 2019.

Non-Taxfilers

To help millions of people, the Treasury Department and the Internal Revenue Service launched a new web tool allowing quick registration for Economic Impact Payments for those who don’t normally file a tax return.

The non-filer tool, developed in partnership between the IRS and the Free File Alliance, provides a free and easy option designed for people who don’t have a return filing obligation, including those with too little income to file. The feature is available only on IRS.gov, and users should look for Non-filers: Enter Payment Info Here to take them directly to the tool.

The tool will request basic information to confirm eligibility, calculate and send the Economic Impact Payments:

-Full names and Social Security numbers, including for spouse and dependents

-Mailing address

-Bank account type, account and routing numbers

To access the non-filer tool, click here: https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

Those who receive benefits, including VA, Social Security retirement or disability benefits (SSDI), Railroad Retirement benefits or SSI, and have no qualifying children, do not need to take any action in order to receive their $1,200 economic impact payment.

Benefit recipients who have qualifying children under age 17 can go to IRS.gov and click on the “Non-Filers: Enter Payment Info Here” button. The tool will request basic information to confirm eligibility, calculate and send the Economic Impact Payments.

Recipients will receive the $500 per dependent child payment in addition to their $1,200 individual payment. If benefit recipients in these groups do not provide their information to the IRS soon, they will have to wait until later to receive their $500 per qualifying child.

For those SSI recipients with dependents who use Direct Express debit cards, additional information will be available soon regarding the steps to take on the IRS web site when claiming children under 17.

The Social Security Administration will not consider Economic Impact Payments as income for SSI recipients, and the payments are excluded from resources for 12 months.

Taxfilers

Use the IRS's "Get My Payment" application to:

-Check your payment status

-Confirm your payment type: direct deposit or check

-Enter your bank account information for direct deposit if the IRS doesn't have your direct deposit information and hasn't sent your payment yet

In situations where payment status is not available, the app will respond with “Status Not Available”. The IRS reminds users they may receive this message for one of the following reasons:

-They are not eligible for a payment (see IRS.gov on who is eligible and who is not eligible)

-They are required to file a tax return and have not filed in tax year 2018 or 2019.

Note: If constituents recently filed their 2018 or 2019 return, or recently provided information through the Non-Filers: Enter Your Payment Info app on IRS.gov, their payment status will be updated when processing is completed.

-If users are a SSA or RRB Form 1099 recipient, SSI or VA benefit recipient – the IRS is working with their agency to issue your payment and their payment information may not be available in the app yet.

To access the "Get My Payment" application, click here: https://www.irs.gov/coronavirus/get-my-payment

Due to high demand you may have to wait longer than usual to access this site.

Veterans Assistance:

Economic Impact Payments

Veterans and their beneficiaries who receive Compensation and Pension (C&P) benefit payments from VA will receive a $1,200 Economic Impact Payment with no further action needed on their part. Timing on the payments is still being determined.

The CARES Act provides eligible taxpayers with qualifying children under age 17 to receive an extra $500. For taxpayers who filed tax returns in 2018 or 2019, the child payments will be automatic.

However, many benefit recipients typically aren’t required to file tax returns. If they have children who qualify, an extra step is needed to add $500 per child onto their automatic payment of $1,200 if they didn’t file a tax return in 2018 or 2019.

For those who receive these benefits – including VA, Social Security retirement or disability benefits (SSDI), Railroad Retirement benefits or SSI – and have a qualifying child, they can quickly register by visiting “Non-Filers: Enter Payment Info” available only on IRS.gov. For those who can use this tool as soon as possible, they may be able to get earlier delivery of the child payments by having these added to their automatic payments.

|

TESTING / COLLECTION LOCATIONS |

|

Where can I get a test? This is a question my office has received since the beginning of this pandemic. Please note that this is not a comprehensive list; there may be more testing sites out there that are added daily. In order to provide as much reliable information as possible, I am including testing sites that are verified through an official communication or news release.

I will keep this section of my newsletter and my website as up-to-date as possible. For any organizations or health care organizations who would like their site listed, or who have updates on their hours or requirements, please email me at common_sense@manchin.senate.gov . |

|

It is recommended that you seek testing only when you begin exhibiting symptoms of COVID-19. Click here to view the screening criteria. To report your symptoms and be directed to one of the available testing sites, contact your primary care doctor or a designated hotline for your area. Most, if not all, sites require a physician's order before testing. If you have gone through these steps and are still having issues getting a test, please email me at common_sense@manchin.senate.gov and a member of my staff will reach out to you to see if we can assist.

Click here for WV DHHR's latest updates to reported COVID-19 cases

Click here to find a testing site near you.

Any new additions or updates will be included below.

- CHARLESTON

LOCATION: Kanawha County Emergency Ambulance Authority, 601 Brooks Street, Charleston, WV 25301

HOURS: Tuesday, April 21, 2020, 10 a.m. – 2 p.m.

In order to be tested, people must have symptoms for the disease, which include coughing, fever and shortness of breath. Testing is by appointment only. For an appointment, call the Kanawha-Charleston Health Department’s COVID-19 hotline at 304-348-1088.

- ELKINS

LOCATION: Davis Medical Center, 812 Gorman Avenue, Elkins, 26241

HOURS: Mon-Friday 10am – 4pm

Due to the current limited availability of COVID-19 test kits, the Centers for Disease Control and Prevention has issued guidelines to qualify patients for COVID-19 testing, therefore not every patient who comes to the DMC drive-thru pre-screening may get COVID-19 testing. High-risk individuals and/or those meeting CDC criteria for COVID-19 testing will be triaged by health professionals for further follow-up.

Children age 10 and under will not be screened at the drive-thru unit. Parents should contact their primary care physician for instructions or contact Davis Medical Center for instructions on making an appointment with a pediatrician. DMC COVID Triage Nurse Available: 304.630.3088

|

|

CONTACT US

Email: common_sense@manchin.senate.gov

Social Media: Facebook Twitter YouTube

Or call the Charleston Office Toll-Free: (855) 275-5737 |

|

|

|

|

|