|

EXPANDED UNEMPLOYMENT INSURANCE

We must take care of those who have lost their jobs through no fault of their own. The CARES Act expands unemployment eligibility to include part-time, self-employed, and gig economy workers; it provides an additional 13 weeks of unemployment benefits; and it increases individual benefits by $600 per week to ensure that no one is penalized for practicing responsible social distancing.

Other increased benefits include:

- Extension of Benefits: Recipients will be allowed to remain on unemployment for an additional 13 weeks through December 31, 2020, expanding the total eligibility period for unemployment benefits from 26 weeks to 39 weeks.

- Waiver of One Week Waiting Period: The federal government and the State of West Virginia no longer require a one week waiting period for new beneficiaries, meaning that unemployed workers can receive benefits as soon as they become unemployed.

ELIGIBILITY

You are eligible if you are unemployed or unable to work because:

- Your place of work is closed as a direct result of COVID-19.

- You or a household member has been diagnosed with COVID-19 or you are experiencing symptoms of the virus and seeking a medical diagnosis.

- You are quarantined because you have been advised by a healthcare provider to self-quarantine due to concerns related to the virus.

- You are caring for a member of the household or a family member that has been diagnosed with the virus or unable to attend a school or facility that is closed and the facility is necessary for you to be able to work.

- You were scheduled to start work and the job no longer exists or you are unable to reach the job because of a quarantine at the workplace.

- You are self-employed, are seeking part-time employment, do not have sufficient work history or would not otherwise qualify for regular unemployment under the State or Federal law.

- Eligible self-employed, independent contractors and gig economy workers will be able to apply for unemployment benefits beginning Friday, April 24, at 10 p.m.

You are NOT eligible for unemployment if:

- You have the ability to telework with pay.

- You are receiving paid leave benefits.

All unemployment received, including the additional $600 through July 31, will be taxable. The amount of unemployment received will be disregarded in determining Medicaid or CHIP eligibility.

To apply For Unemployment through WorkForce West Virginia, click here: https://uc.workforcewv.org/consumer/?lang=en

Questions about applying for unemployment in West Virginia can be directed to Workforce West Virginia by emailing Workforce.COVID19@wv.gov.

PANDEMIC UNEMPLOYMENT ASSISTANCE

The Coronavirus Aid, Relief, and Economic Security (CARES) Act creates a new temporary federal program called Pandemic Unemployment Assistance (PUA).

You may be eligible for PUA if you are self-employed, do not have sufficient work history to qualify for regular UC, or have exhausted your rights to regular UC benefits or extended benefits.

PUA provides up to 39 weeks of benefits to covered individuals who are not eligible for regular UC and who are otherwise able and available to work except that they are unemployed, partially employed, or because of any one of the following COVID-19-related reasons:

• You have been diagnosed with or are experiencing symptoms of COVID-19 and are seeking a medical diagnosis;

• A member of your household has been diagnosed with COVID-19;

• You are providing care for a family member or a member of your household who has been diagnosed with COVID-19;

• Your child or other person in the household for whom you are the primary caregiver is unable to attend school or another facility that is closed due to the COVID-19 pandemic, and that school or facility care is required for you to work;

• You are unable to reach your place of employment because of a quarantine or stay-at-home order due to the COVID-19 pandemic;

• You are unable to reach your place of employment because you have been advised by a health care provider to self-isolate or quarantine because you are positive for or may have had exposure to someone who has or is suspected of having COVID-19;

• You were scheduled to start a new job and do not have an existing job or are unable to reach the job as a direct result of the COVID-19 pandemic;

• You have become the breadwinner/major supporter for a household because the head of your household has died as a direct result of COVID-19;

• You had to quit your job due to being diagnosed with COVID-19 and being unable to perform your work duties;

• Your place of employment is closed as a direct result of the COVID-19 pandemic.

To learn more about Pandemic Unemployment Assistance, click here: https://www.manchin.senate.gov/download/covid-19-pua-faq

DIRECT PAYMENTS TO WEST VIRGINIANS

To address unforeseen financial challenges not covered by expanded Unemployment Insurance benefits or modified Small Business Administration (SBA) loans, the bill authorizes direct payments of $1,200 for individuals and $2,400 for couples. Families are also eligible for an additional $500 per child. Working class Americans that file their taxes will receive a direct payment. Those who are on Social Security or otherwise do not file income taxes will receive their payment in the form of check.

An individual is eligible for the full benefit if they make less than $75,000 per year. Couples and other joint filers are eligible if their combined annual income is less than $150,000. Above that threshold, benefits will be reduced by $5 for every $100 of income and phased out entirely for those making $99,000 or more ($198,000 for couples).

Any individual making $99,000 or more per year will not receive any direct payment. Any couple or other joint filers making $198,000 or more per year will not receive any direct payment.

Veterans and their beneficiaries who receive Compensation and Pension (C&P) benefit payments from VA, and individuals that receive form SSA-1099, which includes those that are receiving Old-Age, Survivor, and Disability (OASDI) benefits through Social Security, and individuals that receive form RRB-1099, which includes those that have worked in jobs covered by the Railroad Retirement Act, will be eligible for the stimulus check and will not be required to fill out any additional tax documents. Veterans, Social Security recipients and railroad retirees who have dependents under the age of 17 can use a new IRS tool online to register to claim the additional $500 per dependent they are eligible to receive.

Non-Taxfilers

To help millions of people, the Treasury Department and the Internal Revenue Service launched a new web tool allowing quick registration for Economic Impact Payments for those who don’t normally file a tax return.

The non-filer tool, developed in partnership between the IRS and the Free File Alliance, provides a free and easy option designed for people who don’t have a return filing obligation, including those with too little income to file. The feature is available only on IRS.gov, and users should look for Non-filers: Enter Payment Info Here to take them directly to the tool.

The tool will request basic information to confirm eligibility, calculate and send the Economic Impact Payments:

- Full names and Social Security numbers, including for spouse and dependents

- Mailing address

- Bank account type, account and routing numbers

To access the non-filer tool, click here: https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

Those who receive benefits, including VA, Social Security retirement or disability benefits (SSDI), Railroad Retirement benefits or SSI, and have no qualifying children, do not need to take any action in order to receive their $1,200 economic impact payment.

Benefit recipients who have qualifying children under age 17 can go to IRS.gov and click on the “Non-Filers: Enter Payment Info Here” button. The tool will request basic information to confirm eligibility, calculate and send the Economic Impact Payments.

By entering this information by Wednesday, April 22, 2020, benefit recipients can receive the $500 per dependent child payment automatically in addition to their $1,200 individual payment. Otherwise, their payment at this time will be $1,200. By law, the additional $500 per eligible child amount would be paid in association with a return filing for tax year 2020.

If benefit recipients in these groups do not provide their information to the IRS by Wednesday, April 22, 2020, they will have to wait until later to receive their $500 per qualifying child.

For those SSI recipients with dependents who use Direct Express debit cards, additional information will be available soon regarding the steps to take on the IRS web site when claiming children under 17.

The Social Security Administration will not consider Economic Impact Payments as income for SSI recipients, and the payments are excluded from resources for 12 months.

TAXFILERS

Use the IRS's "Get My Payment" application to:

- Check your payment status

- Confirm your payment type: direct deposit or check

- Enter your bank account information for direct deposit if the IRS doesn't have your direct deposit information and hasn't sent your payment yet

In situations where payment status is not available, the app will respond with “Status Not Available”. The IRS reminds users they may receive this message for one of the following reasons:

- They are not eligible for a payment (see IRS.gov on who is eligible and who is not eligible)

- They are required to file a tax return and have not filed in tax year 2018 or 2019. Note: If constituents recently filed their 2018 or 2019 return, or recently provided information through the Non-Filers: Enter Your Payment Info app on IRS.gov, their payment status will be updated when processing is completed.

- If users are a SSA or RRB Form 1099 recipient, SSI or VA benefit recipient – the IRS is working with their agency to issue your payment and their payment information may not be available in the app yet.

To access the "Get My Payment" application, click here: https://www.irs.gov/coronavirus/get-my-payment

Due to high demand you may have to wait longer than usual to access this site.

More Information

Senator Manchin's Unemployment Fact Sheet: https://www.manchin.senate.gov/download/cares-act-unemployment

Senator Manchin's Checks For West Virginians Fact Sheet: https://www.manchin.senate.gov/download/cares-act-checks-for-west-virginians

Apply For Unemployment (WorkForce West Virginia): https://uc.workforcewv.org/consumer/?lang=en

IRS Economic Impact Payment Information Center: https://www.irs.gov/coronavirus/economic-impact-payment-information-center

|

|

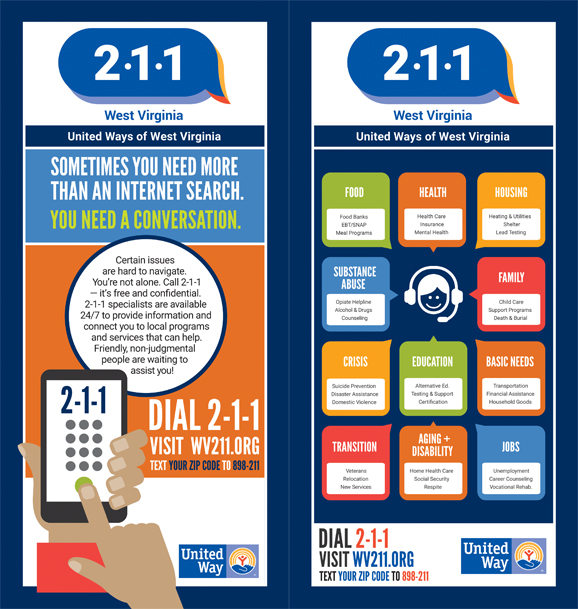

U.S. Senator Joe Manchin (D-WV) is encouraging West Virginians to utilize the 2-1-1 program operated by United Way of West Virginia. 2-1-1 connects callers with health and human services resources through trained certified specialists. Anyone can call 2-1-1 to learn about specific programs, intake requirements, eligibility, operation hours and more.

“United Way of West Virginia provides an important service to West Virginians by helping users navigate the vast number of resources available to aid with healthcare issues, food shortages, mental health questions and more. This program is more important now than ever as we battle the COVID-19 pandemic and I commend United Way for continuing to serve their fellow West Virginians through this time,” Senator Manchin said.

“United Way’s new 2-1-1 will make information on a wide variety of local support services more accessible across our entire state,” said United Way of Central WV President, Margaret O’Neal. “Whether it’s information for locating a health clinic, finding child care programs, or getting housing assistance, 2-1-1 is an easy-to-remember, go-to resource for individuals and families.”

To utilize these resources West Virginians can:

Call 2-1-1

Text your zip code to 898-211

Visit http://www.wv211.org/contact

Call toll-free 1-833-848-9905

|